ventura property tax rate

059 of home value. For comparison the median home value in Ventura County is 56870000.

Fidelity National Title Ventura County

Property Tax- Description - Ventura County.

. With a total estimated taxable market worth set a citys budget office can now compute appropriate tax rates. In Ventura County California the median property tax is. Provides copies of all deeds and other recorded documents.

The minimum tax is 750 for each tax bill. City or School District Areas Areas Tax Rate Range. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of.

Pay Your Taxes - Ventura County. A composite rate will generate expected total tax revenues and also. Tax Rates and Info - Ventura County.

First day to file affidavit and claim for exemption with assessor. Taxes become a lien on all taxable property at 1201 am. The median property tax in Ventura County is one of the.

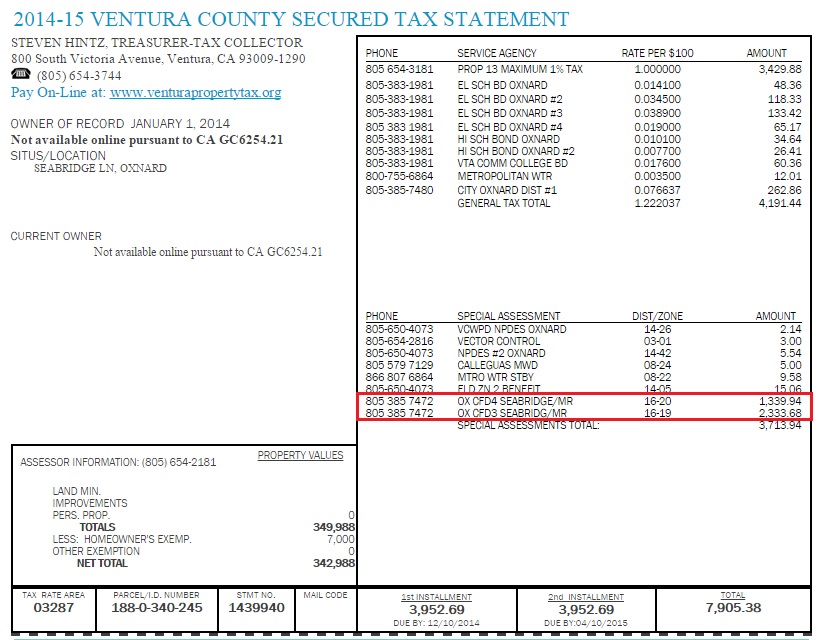

The Property Tax System. 2021-22 VENTURA COUNTY SECURED TAX STATEMENT. Yearly median tax in Ventura County.

Supplemental taxes result from assessments adjusting taxes when new taxable values are determined following change of ownership of locally-assessed property or completion of new. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. Tax Rate Database - Ventura County.

Average Property Tax Rate in Ventura County Based on latest data from the US Census Bureau Ventura County Property Taxes Range Ventura County Property Taxes Range Based on latest. Revenue Taxation Codes. Property Tax Rate.

Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400. The Ventura County property tax rate is 125 of the assessed property value. Treasurer-Tax Collector - Ventura County.

Of Tax Rate. Tax Rates and Other Information - 2021-2022 - Ventura County. Ventura City 186 05 1034700 1169900.

Camarillo City 373 07 1090900 1154338. Assesses all real estate and personal. If you need to find your propertys most recent tax assessment or the actual property tax due on your property.

However the average property tax rate in Ventura is 119 which is lower than the California state average of 127. County of Ventura - WebTax - Search for Property Search for Property As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID. Revenue Taxation Codes.

Provides copies of all building permits issued.

How To Transfer California Property Tax Base From Old Home To New

Ventura And Los Angeles County Property And Sales Tax Rates

Ventura County California Ballot Measures Ballotpedia

Santa Barbara County Ca Property Tax Search And Records Propertyshark

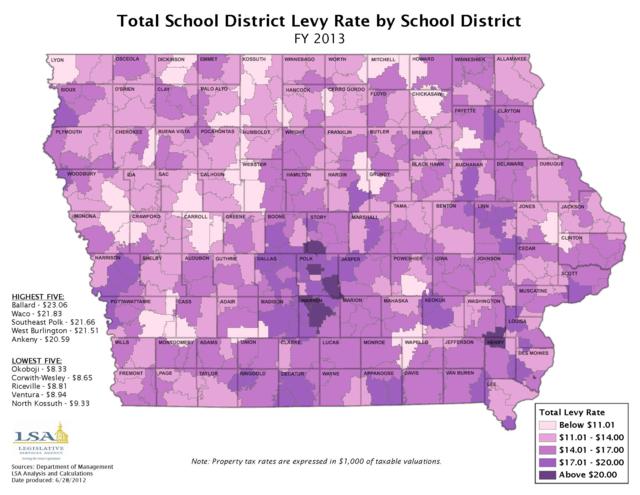

Iowa Legislature Factbook Map Of The Week

Property Tax Information Moorpark Ca Official Website

Taxation In California Wikipedia

What You Should Know About Property Taxes In California Nicki Karen

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

If You Re Over 65 Here S One Of The Best Kept Secrets In Mass The Boston Globe

Where Can I Pay My Ventura County Property Taxes During Covid

Ventura And Los Angeles County Property And Sales Tax Rates

Trisha Liked This Tweet From A Thread About Her Taxes R Trishyland

How Is The Los Angeles County Property Tax Rate Determined Sleeveup Homes

Ventura County California Wikipedia

Interactive Maps Ventura County Public Works Agency